Karachi, May 5, 2025: In a significant and unexpected move, the State Bank of Pakistan (SBP) has reduced its benchmark interest rate by 100 basis points, lowering it to 11%. The decision, announced after the Monetary Policy Committee (MPC) meeting on Monday, will take effect from May 6.

The larger-than-anticipated rate cut comes in response to a notable decline in inflation during March and April. According to the MPC, the easing inflationary trend was driven by a reduction in administered electricity tariffs, lower food prices, and a favourable base effect. Core inflation also slowed in April due to moderating domestic demand.

“This cut is above market expectations,” said Mohammed Sohail, CEO of Topline Securities. “Most analysts had predicted either a 50bps cut or no change at all, citing ongoing global uncertainties.”

While acknowledging the improving inflation outlook, the MPC cautioned against complacency, noting persistent global risks such as volatile trade dynamics and geopolitical tensions. It stressed the need for a balanced monetary approach in the months ahead.

Official data shows that Pakistan’s inflation rate fell to 0.3% year-on-year in April, down from 0.7% in March. The current account posted a $1.2 billion surplus in March, and SBP’s foreign exchange reserves inched up to $10.21 billion as of April 25.

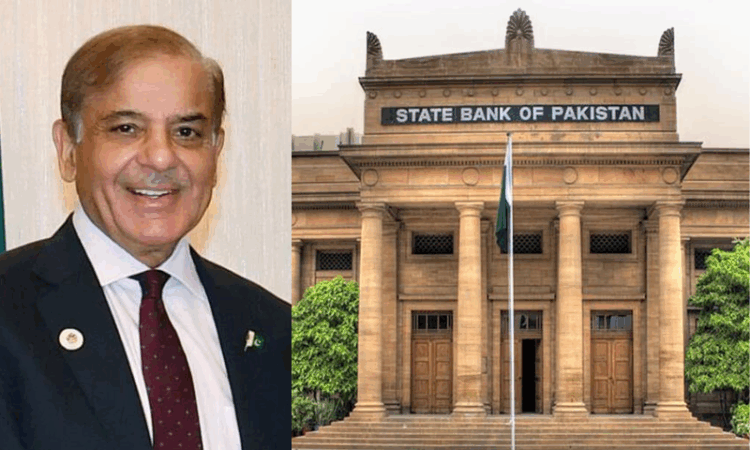

Prime Minister Muhammad Shehbaz Sharif welcomed the SBP’s decision, calling it a timely and encouraging step for the national economy. In a statement, he expressed hope that the policy rate cut would provide much-needed relief to businesses, investors, traders, and the agricultural sector.

“The reduction in the policy rate is a welcome development that will support industry, exports, and overall investment,” the prime minister said. He noted that the significant drop in inflation to 0.3% in April reflected the success of the government’s economic stabilization measures.

Prime Minister Shehbaz also lauded the efforts of the federal finance minister and his team, crediting their policies for the country’s ongoing economic recovery and improving macroeconomic indicators.