Islamabad, May 13, 2025: Prime Minister Shehbaz Sharif on Tuesday directed the concerned authorities to take decisive measures to broaden the tax net and crack down on tax evasion across all capable sectors and individuals.

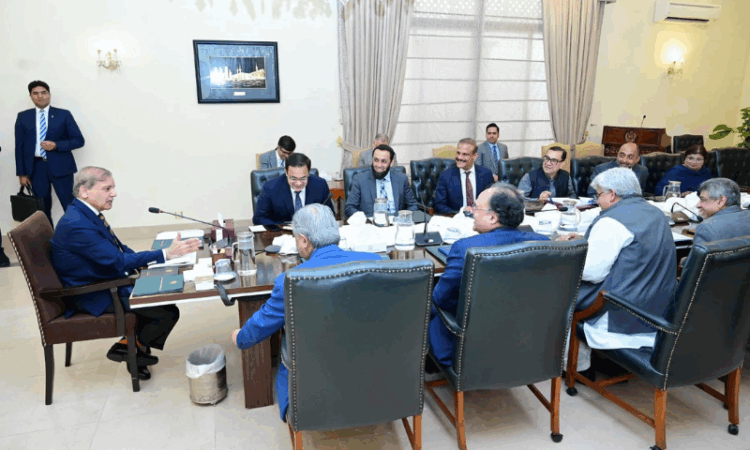

Chairing a high-level review meeting on expanding the tax base and enhancing revenue collection, the prime minister emphasized the urgent need to bring all tax-eligible entities into the system. He also ordered strict accountability for officials and personnel found aiding tax evasion, according to a statement issued by the Prime Minister’s Office.

The prime minister praised the efforts of the government’s economic team for progressing towards the Federal Board of Revenue’s (FBR) revenue targets for the current fiscal year. He reiterated that broadening the tax base is a key government priority aimed at easing the tax burden on the general public by reducing rates for compliant taxpayers.

He instructed that digital monitoring systems, particularly in the cement sector, be fully implemented by next month, and called for accelerated efforts to enhance tax collection from the tobacco industry in coordination with provincial governments.

The prime minister also directed that all pending tax-related cases be actively pursued to ensure recovery of public funds. “By the grace of Allah, the national economy is stabilizing and moving toward sustainable growth,” he said, stressing the need for collective efforts to drive development.

During the briefing, it was revealed that full implementation of the Track and Trace System in cement factories had significantly boosted tax revenues. A similar rollout in the sugar sector had led to a 35% increase in tax revenue between November 2024 and April 2025.

Officials further informed the meeting that ongoing reforms within the FBR are projected to yield a tax-to-GDP ratio of 10.6%.

The meeting was attended by Federal Ministers Azam Nazeer Tarar, Muhammad Aurangzeb, Ahad Khan Cheema, Attaullah Tarar, FBR Chairman, and other senior officials.