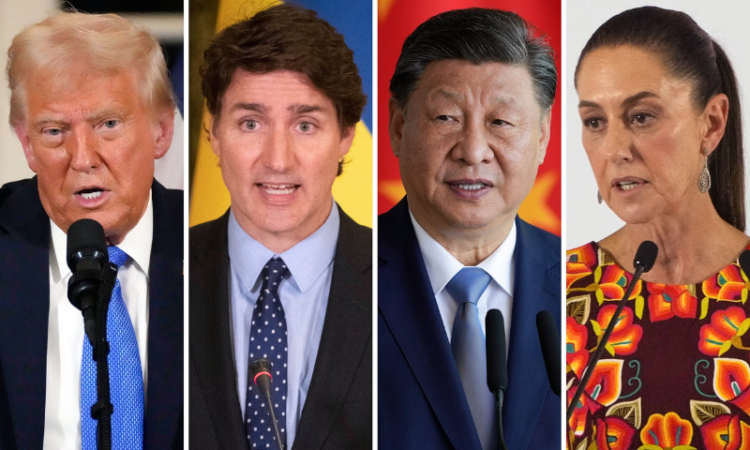

Washington, March 4, 2025: The U.S. has entered a fresh wave of trade conflicts as President Donald Trump’s new 25% tariffs on imports from Canada and Mexico took effect on Tuesday, alongside a doubling of duties on Chinese goods to 20%. The move, which impacts nearly $2.2 trillion in annual trade, comes after Trump accused all three countries of failing to curb the flow of fentanyl and its precursor chemicals into the U.S.

In response, China swiftly announced additional tariffs of 10%-15% on select U.S. imports starting March 10, along with new export restrictions targeting certain American entities.

Canada and Mexico, longtime U.S. trade partners, also vowed swift countermeasures. Canadian Prime Minister Justin Trudeau condemned the tariffs as a “disruption to a highly successful trade relationship”, arguing they violate the U.S.-Mexico-Canada Agreement (USMCA) that Trump himself signed during his first term.

Trudeau unveiled immediate 25% tariffs on C$30 billion ($20.7 billion) of U.S. imports, with an additional C$125 billion ($86.2 billion) in tariffs if the dispute persists beyond 21 days. Canada plans to target American beer, wine, bourbon, home appliances, and Florida orange juice.

Ontario Premier Doug Ford warned that Canada could retaliate further by cutting off nickel exports and halting electricity transmission to the U.S..

Meanwhile, Mexican President Claudia Sheinbaum was set to announce countermeasures later on Tuesday, according to Mexico’s economy ministry.

The latest 10% tariff on Chinese goods adds to an earlier 10% duty imposed on February 4 as part of Trump’s crackdown on fentanyl-linked imports. The cumulative 20% tariff now applies to smartphones, laptops, video game consoles, smartwatches, and Bluetooth devices, products previously untouched by earlier trade wars.

China’s retaliation, announced just after Trump’s tariffs took effect, included new tariffs on U.S. agricultural exports, covering meat, grains, cotton, fruits, vegetables, and dairy products. Beijing also added 15 U.S. firms to its export control list and 10 more to its “unreliable entity” list.

State media, including the Global Times, signaled that Beijing would further target U.S. agricultural and food products, an approach that previously hurt American farmers during Trump’s first-term trade wars, costing them $27 billion in lost sales.

The tariffs on Mexican and Canadian imports could significantly disrupt North America’s integrated economy, affecting supply chains in automotive, energy, and agriculture sectors.

The Canadian Chamber of Commerce CEO, Candace Laing, criticized Trump’s move as “reckless”, warning that it could push both Canada and the U.S. toward recession. She argued that tariffs would fail to deliver the “golden age” Trump envisions, instead driving higher costs for consumers and businesses.

Similarly, Matt Blunt, president of the American Automotive Policy Council, urged exemptions for vehicles that meet USMCA’s regional content rules, fearing tariffs could cripple the auto industry.

Trump’s tariff escalation rattled global financial markets, causing stock markets to tumble and investors to flee to safe-haven assets. The Canadian dollar and Mexican peso fell against the U.S. dollar, further fueling economic concerns.