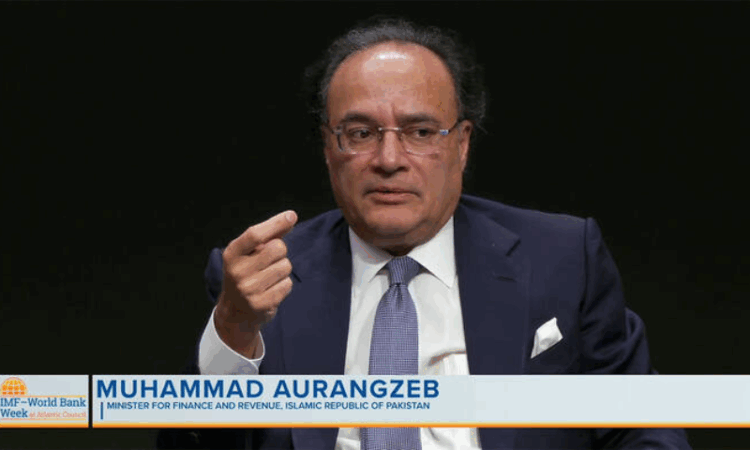

Washington, April 23, 2025: Finance Minister Muhammad Aurangzeb has said that Pakistan is witnessing early signs of economic stability, but urged continued discipline and reform to avoid repeating past policy missteps.

Speaking at the Atlantic Council’s GeoEconomics Center on the sidelines of the IMF-World Bank Spring Meetings in Washington, Aurangzeb outlined Pakistan’s economic outlook, reform agenda, and the importance of sustained collaboration with global financial institutions.

Using a cricket metaphor, the minister remarked that Pakistan has “put some runs on the scoreboard,” citing improved foreign reserves, a positive trend in inflation, an upgraded credit outlook, and a shrinking fiscal deficit. However, he cautioned that these are preliminary gains and emphasized the need for structural reforms to ensure long-term economic resilience.

Aurangzeb highlighted a 29% surge in tax revenues, projecting that the tax-to-GDP ratio will reach 10.6% by the end of the fiscal year. He noted improved debt management and cost-saving strategies have created fiscal space, allowing for more targeted development spending.

For the first time, agricultural income has been brought under the tax framework — a step the minister described as a significant policy shift aimed at broadening the revenue base.

He also underscored the importance of coordination with provincial governments through the National Finance Commission (NFC) to align fiscal policies and achieve shared development goals.

Expanding the formal economy remains a key focus, Aurangzeb said, noting that a large volume of cash remains outside the formal financial system. To address this, he outlined measures such as digital audits, track-and-trace systems, and faceless customs processes to strengthen enforcement and transparency.

The minister also addressed major social and environmental challenges, including population growth, education, and climate change, calling for long-term, integrated strategies to address these complex issues.

On climate finance, Aurangzeb announced the development of a Green Taxonomy Framework aimed at supporting sustainable investments through instruments such as green bonds and sukuks.

He welcomed continued engagement with multilateral lenders — including the IMF, World Bank, and Asian Development Bank — and praised their support through new financing arrangements.

Concluding his remarks, Aurangzeb called for a rethinking of global financial governance, proposing the creation of a dedicated platform to streamline concessional finance for developing nations.